A Martin Lewis Child Trust Fund guide is essential for anyone trying to track down lost savings or manage these accounts today. Child Trust Funds (CTFs) are savings accounts set up by the UK government for children born between 2002 and 2011. Millions of these accounts exist, but many families have forgotten about them. Martin Lewis, the money-saving expert, has shared advice to help people find and manage these funds. Let’s break down what you need to know.

What Is a Child Trust Fund?

A Child Trust Fund is a tax-free savings account created by the UK government. Every child born between September 1, 2002, and January 2, 2011, got a CTF with an initial £250 voucher from the government (or £500 for low-income families). Parents, relatives, or friends could add up to £9,000 total to the account over time. The money belongs to the child and becomes accessible when they turn 18.

In 2024-2025, many CTFs are maturing, as the oldest children turn 22. But thousands of accounts remain unclaimed because families lost track of them or never opened one.

Why Is Martin Lewis Involved?

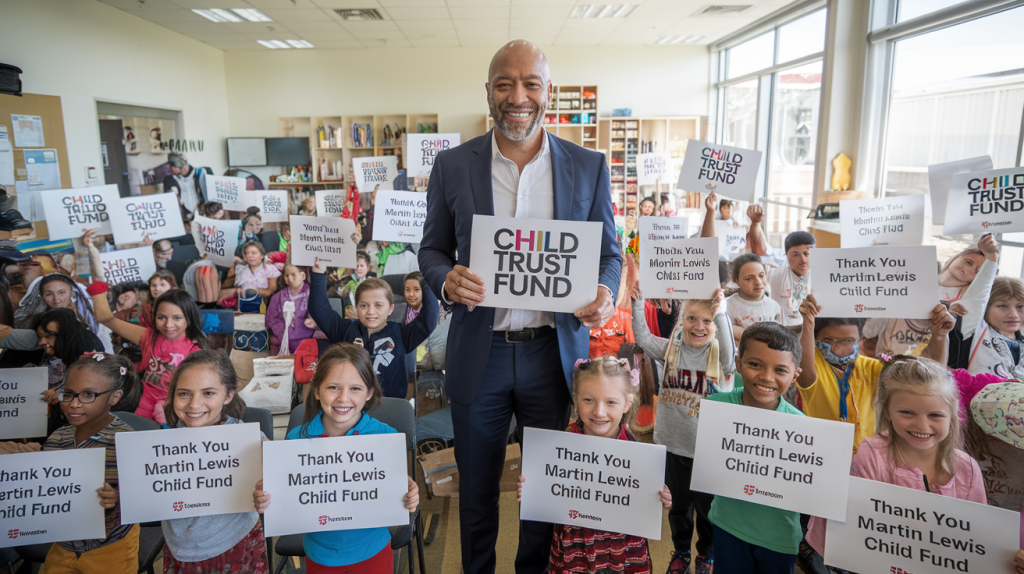

Martin Lewis, founder of MoneySavingExpert.com, has campaigned to help families find “lost” Child Trust Funds. In 2020, he worked with the UK government to create a free online tool for tracking down CTFs. His website also shares step-by-step guides for transferring funds or claiming money.

Lewis warns that unclaimed CTFs risk losing value over time due to fees or poor investment returns. He urges families to act now, especially as children born in 2006-2011 start turning 18 in 2024-2025.

How to Find a Child Trust Fund

If you’re not sure whether a CTF exists for your child (or yourself), here’s how to check:

- Use the Government’s Online Tool: Visit GOV.UK’s CTF service and enter the child’s details (name, date of birth, address). This works for parents, guardians, or the child (if they’re 16+).

- Contact HMRC: Call HMRC at 0300 123 1072 if the online tool doesn’t work. You’ll need the child’s National Insurance number.

- Check Old Paperwork: Look for letters from CTF providers like OneFamily, Foresters Friendly, or Barclays.

Martin Lewis’s website has a free template letter to send to HMRC if you’re struggling to get information.

Managing a Child Trust Fund in 2024-2025

Once you find a CTF, you have options:

- Leave It Until the Child Turns 18: The account stays tax-free, and the child can withdraw the money at 18.

- Transfer to a Junior ISA: Junior ISAs often have better interest rates or investment options. You can move the CTF money without losing tax benefits.

- Withdraw Early (In Rare Cases): If the child is terminally ill, you may be able to access the funds early.

Martin Lewis advises comparing CTF performance to Junior ISAs. If the CTF has high fees or low returns, switching could save money.

What Happens When the Child Turns 18?

In 2024-2025, many young adults are discovering CTFs they never knew about. When the child turns 18, the account becomes a regular savings account in their name. They can:

- Withdraw all the money.

- Keep saving in the account (though it’s no longer tax-free).

- Transfer the funds to an adult ISA.

Martin Lewis warns young adults to avoid spending the money impulsively. He suggests using it for education, a home deposit, or emergencies.

Case Study: Amy’s Story

Amy, born in 2005, had a CTF set up by her grandparents. Her family forgot about it until 2024, when she turned 19. Using Martin Lewis’s guide, Amy’s mom tracked down the account, which had grown to £3,200. They transferred it to a Junior ISA with better returns, giving Amy more money for university.

Challenges and Complaints

Some families face issues with CTF providers:

- Lost Accounts: Providers like Children’s Mutual closed or merged, making it harder to track funds.

- Poor Communication: Many parents never received updates about the account’s growth.

- Low Returns: Some CTFs grew by only 1-2% per year, while Junior ISAs offered 5%+ in 2024.

Martin Lewis encourages families to complain to the Financial Ombudsman if providers aren’t helpful.

FAQs

How do I find a lost Child Trust Fund?

Use the GOV.UK tool, call HMRC, or check old paperwork. Martin Lewis’s website has free templates to help.

Can I still add money to a Child Trust Fund?

No, CTFs closed to new contributions in 2011. You can open a Junior ISA instead.

What if the child passed away?

Contact the CTF provider. Funds can be released to the family after providing a death certificate.